Features

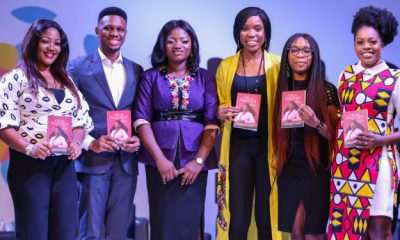

Ayo Akinola, Tosin Olaseinde, Abdulraheem Olanihun, Adekunle Owolabi Lead Finance and Tech Conversations at New Media Conference 2022 Edition

The 7th edition of the New Media Conference was held on Saturday, October 29, 2022, in Lagos at the British Council Nigeria with physical and virtual attendees from across the continent. The 2022 edition focused on how viral media is shaping different facets of human interaction including arts, technology, finance, fashion, content creation, and politics. According to Oluwatosin Ajibade, Founder/Convener, of New Media Conference and OSG Media Limited, “Understanding what the Viral Economy is, the opportunities and challenges it presents for all, and how to position within the space is imperative.”

Finance and technology specialists have pointed to the rising popularity of viral social media platforms as positive for financial literacy and awareness in Nigeria. Experts at the 2022 edition of the New Media Conference (NMC) themed “The Viral Economy”, said that while financial technology is not new, the young demographic of Nigeria and its adoption of smartphones present a unique opportunity to propagate education on money, saving, and investment.

“Viral media is very important, and we have not scratched the surface yet,” said Tosin Olaseinde, CEO and Founder of Money Africa and Ladda. “People should be talking about money in local dialects,” Tosin explained that money plays an important role in the day-to-day life of the average Nigerian, however conversations around money management are not common, a culture which has to be improved.

In addition, Ayo Akinola, Nigerian tech entrepreneur, public speaker, motivational life coach, and co-founder of Piggyvest, PocketApp, and Patronize, advocated for more Finfluencers that provide byte size easy-to-understand information about finance as a way to bridge gaps in financial awareness. Beyond the consumers, he also noted that viral media is important for finance companies and brands to engage and build trust with their users. “Fintech companies have to use the media to promote their offerings and market to users,” he added.

Despite the upsides, the panels highlighted some limitations of viral media as a tool for advancing financial literacy. “First is misinformation which is when people do not verify what they share and the other is the increase in the promotion of unethical products,” said Abdulraheem Olanihun, Product manager of Chipper Cash Nigeria. Furthermore, Tosin mentioned that viral media per se is not sufficient to close the financial gender disparity for women. “We need to pay women as much as we pay their male counterparts,” said Tosin. “It is easy to get lost in fanciful terms but if women are not paid, nothing will change.”

To solve the challenges of financial education in an age of over-sharing, misinformation, and Ponzi schemes, Adekunle Owolabi advised better regulation and collaboration between the private and public sectors. “The government needs to work with the industry and that is the only way we can move forward,” he said. Ayo added that social media users should rely on information from verified sources and develop a culture of research. “Follow people that know what they are saying and compare information,” he said.

The panel session was moderated by Eric ‘Knewkeed’ Okafor, technology expert, and content creator. The event was hosted by Isabella Adediji, the founder of Yellow Tamarind Productions, a media, and PR company based in Lagos, and supported by The British Council Nigeria.

The event is powered by OSG Media and supported by the British Council Nigeria. Media partners for the event are News Central TV, Goldmyne TV, and Media Room Hub. For more information, visit www.newmediaconference.ng.

Recent Comments